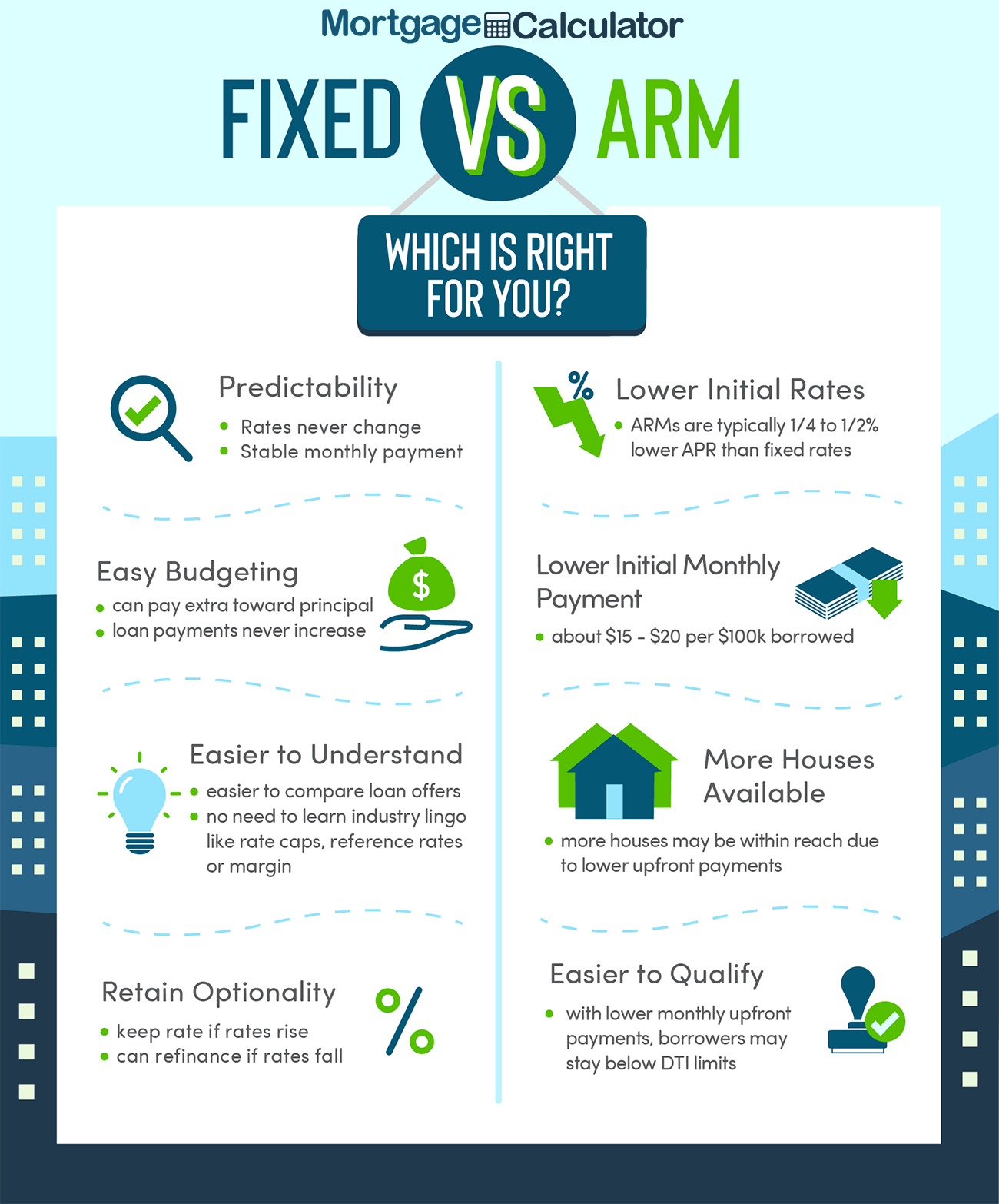

An adjustable rate mortgage, often referred to as an ARM, is a type of home loan with an interest rate that fluctuates with the market. This is in perfect contrast to the fixed-rate mortgage, which has the same interest rate for the life of the loan, meaning your monthly payments stay the same.

Prospective home buyers have the choice between an adjustable rate and a fixed rate mortgage, so it is important to understand their differences. An ARM home loan has two periods: the fixed period and the adjustment period. The fixed period is at the beginning of the loan’s life (generally the first 5-10 years) and during this time your interest rate will not change. The adjustment period is when your interest rate may fluctuate depending on the market. It is important to note that with an ARM in the fixed period, you will likely have a lower rate initially. The concern many have with this type of loan is that if interest rates spike during the adjustable period, so does your rate. The reverse is also true, meaning if interest rates fall dramatically, so does your rate.

As we see rising interest rates going into 2023, you may consider asking a lender about the option of doing an ARM loan. You will be given a smaller initial interest rate during your fixed period with the hope that once you reach the adjustable period, inflation and interest rates will go down, making your monthly payments smaller. It’s also important to remember that you can always refinance!

NOTE: Always ask your lender any pertinent questions about loans! Whereas realtors are very market savvy, the lenders specialize in mortgages and interest rates. So, ask an expert before you make your decision.